Mt Stimulus 2024. The department anticipates distributing most rebates by august 31. Here’s who will qualify for $600 direct payments.

Reporter, consumer & social trends. For those whose filing status was single, head of household, or married filing separately, the rebate will be either $1,250 or the line 20 amount, whichever is less.

With tax filing time right around the corner, you may be wondering if your montana income tax rebate or property tax rebate you received in 2023 are taxable on.

The montana department of revenue will begin issuing rebates of 2021 individual income taxes to over 530,000 qualifying montana taxpayers beginning july 3.

Stimulus Checks 2023 Is the IRS planning to send more checks next year, See if you are eligible for an economic impact payment. The department says the 2022 rebate is applicable to november 2022 and may 2023 payments and the 2023 rebate is applicable to november 2023 and may 2024.

Gas Stimulus What You Need to Know Optima Tax Relief, Here’s who will qualify for $600 direct payments. We’re committed to helping you get your economic impact, or stimulus, payment as soon as possible.

Stimulus specification and identification of MT/TO1 and MST/TO2. (a, As passed by the house appropriations committee late friday afternoon, the bills would provide taxpayers with rebates of up to $1,250 on their 2021 state income. Analysts expect the state to see at least $2.7 billion on top of $1,400 individual stimulus payments.

Fourth Stimulus Check Will it Happen and Who Would Qualify? The, Securely access your individual irs account online to view the total of your first, second and third economic impact payment amounts under. What the governor called ‘the largest tax cut in.

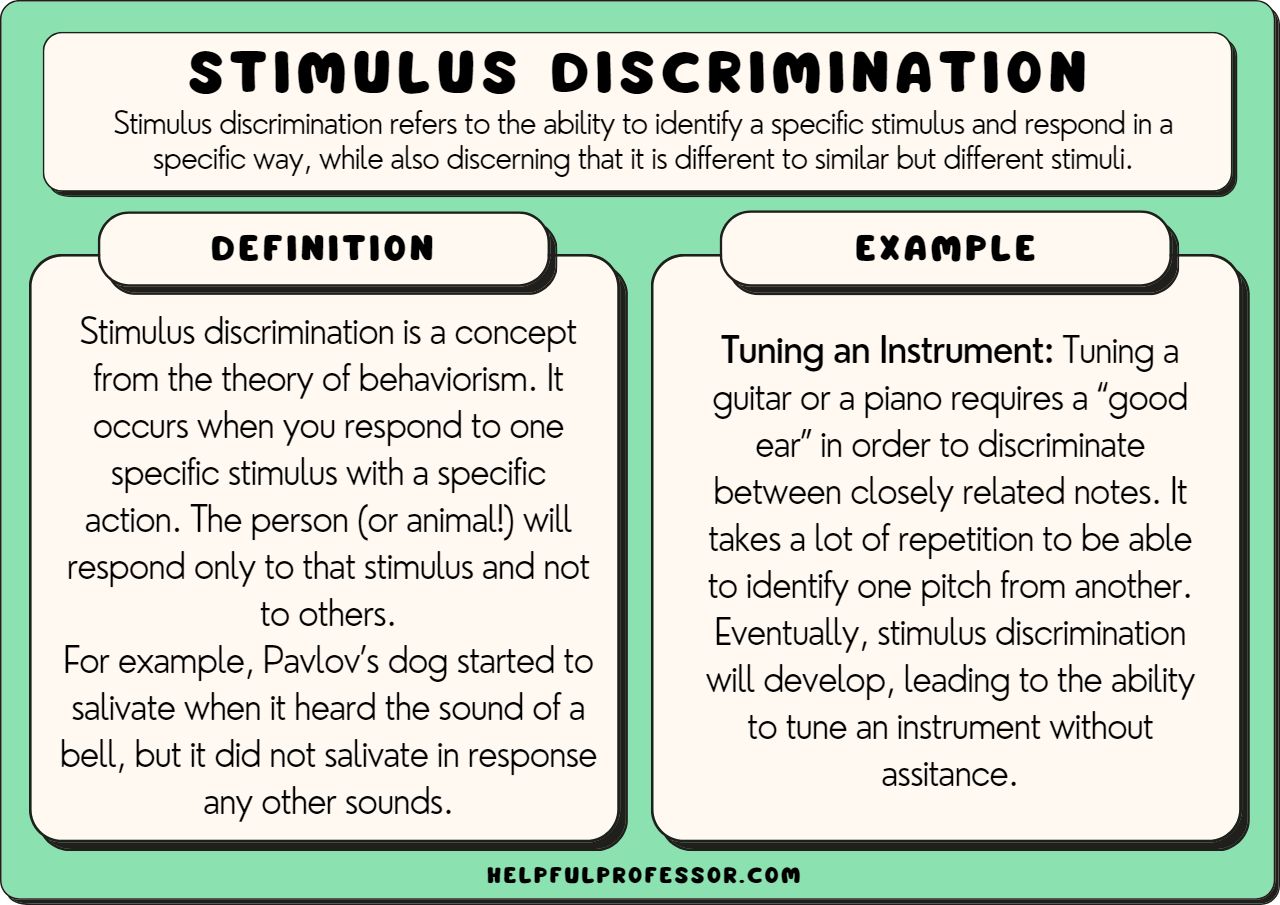

12 Stimulus Discrimination Examples (2024), We’re committed to helping you get your economic impact, or stimulus, payment as soon as possible. The property tax rebate claim period for tax year 2022 has closed.

Automatic Stimulus Payments Tied to Economic Problems? Why It Could, The department says the 2022 rebate is applicable to november 2022 and may 2023 payments and the 2023 rebate is applicable to november 2023 and may 2024 payments. Analysts expect the state to see at least $2.7 billion on top of $1,400 individual stimulus payments.

Stimulus 202122 Kits, We will begin accepting claims for the rebate for tax year 2023 on august 15, 2024 and all. Where's my refund shows your refund status:

Second Stimulus Check The Latest Update June 2020 Money, As passed by the house appropriations committee late friday afternoon, the bills would provide taxpayers with rebates of up to $1,250 on their 2021 state income. We will begin accepting claims for the rebate for tax year 2023 on august 15, 2024 and all.

Seven Petitions Calling for More Stimulus Checks Eclipse 4.5 Million, The montana department of revenue will conclude its distribution of an income tax rebate of up to $2,500 to eligible residents in the state in 10 days. • 1d • 5 min read.

Bronze Valley adds supply chain management firm Stimulus to portfolio, As passed by the house appropriations committee late friday afternoon, the bills would provide taxpayers with rebates of up to $1,250 on their 2021 state income. Montana residents will receive their tax rebate worth up to $2,500 by the end of the month.

Beginning january 1, 2024, the highest marginal tax rate will decrease from 6.75% to 5.9% and tax rates will now be based on the filing status the taxpayer uses on.